litrosfera.ru

News

Interactive Brokers Futures Minimum

The minimum value of the collateral is set by the exchange upon which the futures contract trades, while the broker may require additional collateral on top to. To start trading futures on interactive brokers, you will need to make a minimum deposit of $10, This is the requirement set by interactive brokers to. Anyway most futures are designed to be $50kk in underlying. For less volatile assets (like SOFR) more like $1m. There are microfutures . trading these futures through Interactive Brokers. We instead recommend The first thing that you should do is to make certain that you have the minimum. Broker Accounts. A USD 10, (or non-USD equivalent) up front deposit will be required that will be applied against commissions during the first 8 months. Minimum balance, $10,*, $0. Minimum activity charge, Yes, No. Real-Time data charges, Yes, No. Specializes exclusively in Futures and Options, No, Yes. "Professionals can take advantage of industry-leading commissions, including the lowest margin rates across all balance tiers." Futures trading at IBKR. Start. Margin is the amount of cash a client must put up as collateral to support a futures contract. For securities, margin is the amount of cash a client borrows. Micro Futures Benefits · Around-the-clock Access. Futures contracts are tradeable nearly 24 hours a day, providing access when other markets are closed · Price. The minimum value of the collateral is set by the exchange upon which the futures contract trades, while the broker may require additional collateral on top to. To start trading futures on interactive brokers, you will need to make a minimum deposit of $10, This is the requirement set by interactive brokers to. Anyway most futures are designed to be $50kk in underlying. For less volatile assets (like SOFR) more like $1m. There are microfutures . trading these futures through Interactive Brokers. We instead recommend The first thing that you should do is to make certain that you have the minimum. Broker Accounts. A USD 10, (or non-USD equivalent) up front deposit will be required that will be applied against commissions during the first 8 months. Minimum balance, $10,*, $0. Minimum activity charge, Yes, No. Real-Time data charges, Yes, No. Specializes exclusively in Futures and Options, No, Yes. "Professionals can take advantage of industry-leading commissions, including the lowest margin rates across all balance tiers." Futures trading at IBKR. Start. Margin is the amount of cash a client must put up as collateral to support a futures contract. For securities, margin is the amount of cash a client borrows. Micro Futures Benefits · Around-the-clock Access. Futures contracts are tradeable nearly 24 hours a day, providing access when other markets are closed · Price.

Individual traders can open a futures account with Interactive Brokers to trade futures on their own. This type of account requires a minimum deposit of $10, requirements of individual customers. Before acting on this About Interactive Brokers · Privacy · Cyber Security Notice. © Interactive Brokers, LLC. Interactive Brokers is a well-known brokerage company that offers futures trading to its clients. Here are some of the pros and cons of using Interactive. minimum of $, are priced with tight spreads, and are Before trading security futures, read the Security Futures Risk Disclosure Statement. Learn where to look for margin amounts held by Interactive Brokers when you buy and sell futures contracts minimum. Margin can be set at % of the. Get the margin requirements for trading futures & FOPs based on your residence and exchange location. What is the minimum amount required to get started? The minimum account balance required to maintain a live data connection is $ · When do Day Trade Margins. Small Exchange Futures ; All Contracts, USD /contract ; Fees to offset exchange and regulatory fees paid by IBKR · Exchange Fees; Regulatory Fees; Clearing. minimum of $, are priced with tight spreads, and are Before trading security futures, read the Security Futures Risk Disclosure Statement. Interactive Brokers requires a minimum deposit of $10, for trading. Can I use this deposit for trading, or do I need extra money? Views. Pattern Day Traders have to maintain a minimum account balance of $25, in their margin accounts. This allows them to engage in unlimited day trading. Brokers. IBKR offers a comprehensive suite of order types, algorithms and trading tools to help you accomplish your commodity futures trading or risk management. minimum amount. The exchange monitors the price variation of About Interactive Brokers · Privacy · Cyber Security Notice. © Interactive Brokers, LLC. The rate for futures is $/contract, with a $ minimum, and futures options cost $1/contract with a minimum per-order commission of $ Margin Rates. Interactive Brokers ®, IBSM, litrosfera.ru ®, Interactive Analytics Futures Trading Commission. Headquarters: One Pickwick Plaza. Initial margin is the minimum amount set by a futures exchange platform to enter a futures position. Futures Margin at Interactive Broker. At Interactive. There is no minimum deposit required by Interactive Brokers. Infact it is an international firm and suitable for investments. Look into to. IB provides access to trading Equities, ETFs, Options, Futures, Future Options, Forex, CFDs, Gold, Warrants, Bonds, and Mutual Funds for clients in over Broker Accounts. A USD 10, (or non-USD equivalent) up front deposit will be required that will be applied against commissions during the first 8 months. You can day trade futures or forex at Interactive Brokers without maintaining $25, in account equity. In all cases, day and swing traders at Interactive.

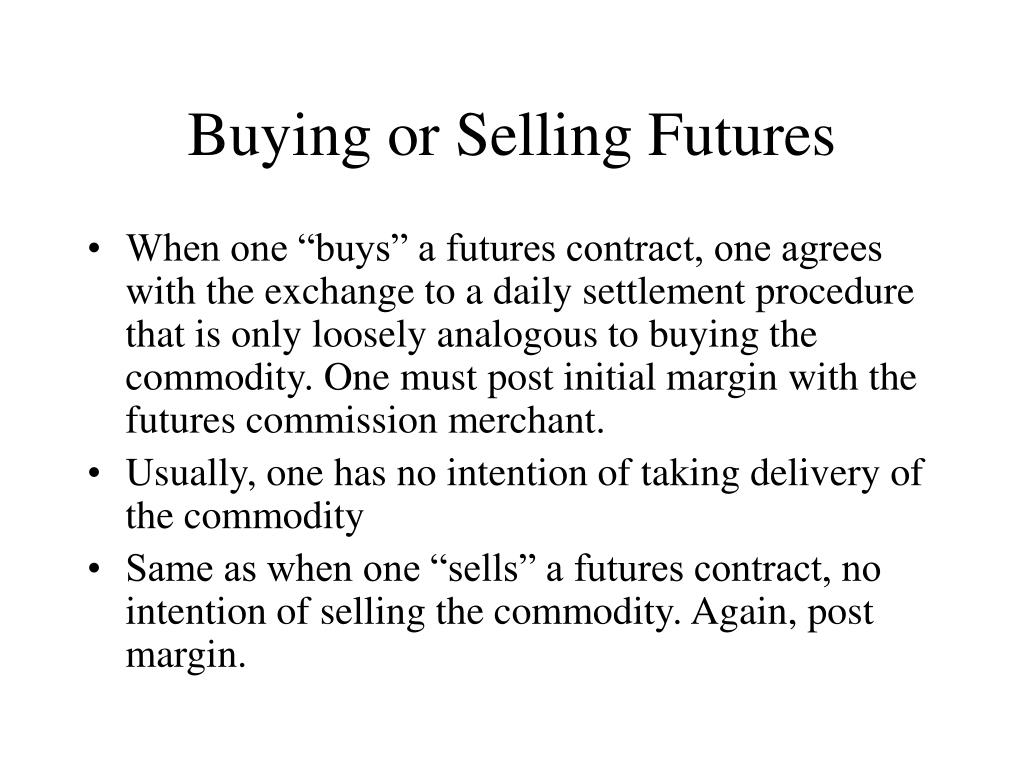

Buying And Selling Futures Explained

Futures are financial contracts that obligate the buyer to purchase an asset (or the seller to sell an asset) at a predetermined future date and price. A Futures contract is a legal agreement involving the sale and purchase of a certain commodity, asset, or security at a predetermined price and date in the. Futures are a type of derivative contract agreement to buy or sell a specific commodity asset or security at a set future date for a set price. A business person, e.g. a hog farmer or a Canadian exporter are exposed to risk. To offset this risk, they can "hedge" by buying or selling a futures contract. Investors in India can trade in futures on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). Let us see how to trade in futures in India. A futures exchange, which writes the terms of each contract and makes it available for trading, but does not specifically issue it. Buyers and sellers create an. These are financial contracts in which two parties – one buyer and one seller – agree to exchange an underlying market for a fixed price at a future date. What is Futures Trading? Futures are financial derivatives that bring together the parties to trade an item at a fixed price and date in the future. Regardless. Futures are standardized contracts that represent an agreement between two parties, a buyer and a seller, to trade a particular asset at a set price before. Futures are financial contracts that obligate the buyer to purchase an asset (or the seller to sell an asset) at a predetermined future date and price. A Futures contract is a legal agreement involving the sale and purchase of a certain commodity, asset, or security at a predetermined price and date in the. Futures are a type of derivative contract agreement to buy or sell a specific commodity asset or security at a set future date for a set price. A business person, e.g. a hog farmer or a Canadian exporter are exposed to risk. To offset this risk, they can "hedge" by buying or selling a futures contract. Investors in India can trade in futures on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). Let us see how to trade in futures in India. A futures exchange, which writes the terms of each contract and makes it available for trading, but does not specifically issue it. Buyers and sellers create an. These are financial contracts in which two parties – one buyer and one seller – agree to exchange an underlying market for a fixed price at a future date. What is Futures Trading? Futures are financial derivatives that bring together the parties to trade an item at a fixed price and date in the future. Regardless. Futures are standardized contracts that represent an agreement between two parties, a buyer and a seller, to trade a particular asset at a set price before.

Definition of a futures contract. A futures contract gives the buyer (or seller) the right to buy (or sell) a specific commodity at a specific price at a. An option on a futures contract gives the holder the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option). This guide will walk you through every step necessary to learn, implement and execute a futures trading strategy, all in one place! Unlike margin trading in the equity market, futures margin is not a loan. The amount of initial margin (i.e., required upfront capital) is small relative to the. Basics of Futures Trading. A commodity futures contract is an agreement to buy or sell a particular commodity at a future date; The price and the amount of. Stock futures are financial contracts that enable you to buy or sell stock at a specific price and on an agreed-upon date in the future. The exchange also guarantees that the contract will be honored, eliminating counterparty risk. Every exchange-traded futures contract is centrally cleared. This. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at. Futures are derivatives that take the form of a contract in which two traders agree to buy or sell an asset for a specified price at a future date. However, you cannot realize a profit in futures trading until you “flatten” your position – placing an order for the same quantity on the opposite side of the. In finance, a futures contract (sometimes called futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at. By agreeing to buy (or sell) the futures agreement, one gives the other consent to honour the contract specifications. The margin block – After the signoff is. A futures contract is a legal agreement to buy or sell a commodity asset, such as oil or gold, at a predetermined price at a specified time in the future. A future is you agreeing to buy something, well, in the future. Options are similar, but you're only buyinG the option to buy or sell. So I. A futures contract is an agreement to buy or sell an underlying asset at a later date for a predetermined price. It's also known as a derivative. In this article, you will explore the futures trading basics with MEXC Learn. This simple guide will help you to easily understand the derivatives market. If you expect a futures market's price to be higher in the future than it is today, you would buy a futures contract, or “go long.” If you are right about both. Types of futures trading can be defined as the strategies that traders and investors use to buy and sell futures contracts to make a profit or manage risk. A long position in traditional trading is when you buy an asset in the expectation its price will rise, so you can sell it later for a profit.

Mba After Mbbs In Usa

An MBA after MBBS in the USA: An MBA after MBBS in the USA can propel your healthcare career. Benefits include leadership skills, higher income, diverse career. The MD/MBA program will prepare students to compete and succeed in a changing health care environment. The schedule for the MD/MBA degrees provides a. MBA after MBBS is an excellent course choice for doctors as it allows them to shift towards a career in healthcare administration and management. The MD/MBA program will prepare students to compete and succeed in a changing health care environment. The schedule for the MD/MBA degrees provides a. Dr. Mba has given talks and presented workshops on clinical reasoning at regional and national meetings of the Society of Hospital Medicine and the American. Since , the state's flagship medical school, with one of the largest student bodies in the nation, has been educating the next generation of physicians. An MBA done after MBBS will give you access to the healthcare business industry and, second, allow you to work in different locations because your MBA will be. Earning an MBA with a concentration in healthcare administration might be ideal for students who envision pursuing a career in healthcare but who also want to. MBA after B Pharmacy could be a beneficial addition to your credentials. Bachelors in USA are equally as popular as Masters Courses. Studying a. An MBA after MBBS in the USA: An MBA after MBBS in the USA can propel your healthcare career. Benefits include leadership skills, higher income, diverse career. The MD/MBA program will prepare students to compete and succeed in a changing health care environment. The schedule for the MD/MBA degrees provides a. MBA after MBBS is an excellent course choice for doctors as it allows them to shift towards a career in healthcare administration and management. The MD/MBA program will prepare students to compete and succeed in a changing health care environment. The schedule for the MD/MBA degrees provides a. Dr. Mba has given talks and presented workshops on clinical reasoning at regional and national meetings of the Society of Hospital Medicine and the American. Since , the state's flagship medical school, with one of the largest student bodies in the nation, has been educating the next generation of physicians. An MBA done after MBBS will give you access to the healthcare business industry and, second, allow you to work in different locations because your MBA will be. Earning an MBA with a concentration in healthcare administration might be ideal for students who envision pursuing a career in healthcare but who also want to. MBA after B Pharmacy could be a beneficial addition to your credentials. Bachelors in USA are equally as popular as Masters Courses. Studying a.

The Carlson School of Management at the University of Minnesota features a full-time MBA with a medical industry specialization. Courses cover areas like. An MBA after MBBS in the USA: An MBA after MBBS in the USA can propel your healthcare career. Benefits include leadership skills, higher income, diverse career. MBA/MBBS: Generally medical graduates choose MS/MD as their further career scope to make a career in the Medical profession. But, if you are someone who. The Physician Executive MBA is ideal for full-time physicians with a medical doctorate who plan to continue working while earning their degree. We designed our. Benefits of MBA after MBBS include expanded work opportunities, salary enhancement, entrepreneurial skills development, leadership opportunities. The United States is in the middle of a 10 year boom in health care job creation and the time has never been better to earn an affordable MBA in healthcare. Students may indicate their interest in the MD-MBA joint degree upon being accepted to medical school, but they typically will not apply to the business program. After a bachelor degree in MBBS from the USA, the students will be qualified as MD. Students can venture into various fields after MD like specialisation, PG or. One of the most popular upcoming courses after MBBS is a Masters in Medical Sciences and Technology, this new area combines both sciences and technology. After a bachelor degree in MBBS from the USA, the students will be qualified as MD. Students can venture into various fields after MD like specialisation, PG or. Are you planning to do MBA in Healthcare Management in USA? We at Yocket will help you find an MBA in healthcare Management in USA Universities and other. Popular foreign universities for MBA programs · Research after MBBS · litrosfera.ru – Ph. · Other Options: Working in primary health Centre, private hospital. Additionally, MBA courses after MBBS opens up another door of opportunities for students. Moreover, the field of healthcare is revolutionizing due to people who. Popular foreign universities for MBA programs ; Columbia Business School - Columbia University, USA ; Darden School of Business - University of Virginia, USA ; The. Other career options for MD/MBA students are wide ranging and may include becoming a medical director, a consultant to pharmaceutical companies or a director of. To practise medicine, one must obtain a licence from the appropriate state's medical board (M.D.). After passing the USMLE, there are several different. After medical school you will need to apply and match to a residency program in which you learn your chosen medical specialty. The Physician Executive MBA is ideal for full-time physicians with a medical doctorate who plan to continue working while earning their degree. We designed our. Master of Medical Management (MMM) · Master in Business Administration (MBA) · Master in Healthcare Quality and Safety Management (MS-HQSM) · Master of Science in. Since the School was established in , faculty members have improved human health by innovating in their roles as physicians, mentors and scholars.

Price Of D2o

Today's D2O share price, stock chart and announcements. View dividend history, insider trades and ASX analyst consensus. d2O/xcUSDT price today is $ with a hour trading volume of $ Deuterium contract address is 0xcbcbafa0ba9f7e3be9bf with. Pricing. · Deuterium oxide, atom % D. View. View Pricing. · Deuterium oxide, deuteration degree min. % for NMR spectroscopy MagniSolv. Calculating The Fair Value Of Duxton Water Limited (ASX:D2O). Simply Wall St Price/Sales (ttm). Price/Book (mrq). Enterprise Value/Revenue. Deuterium (D2O) is worth ¥ as of May 30, (15 days ago). There has not been any price movement for D2O since then. Should there be any price. View today's D2O share price, options, bonds, hybrids and warrants. View announcements, advanced pricing charts, trading status, fundamentals. Deuterium Price Overview. The current Deuterium price is €. The price has changed by % in the past 24 hours on trading volume of €. 28 August - The Deuterium price today is USD. View D2O-USD rate in real-time, live Deuterium chart, market cap and latest Deuterium News. D2O. Melting point, 3,81°C. Boiling point, ,42°C. MW, 20, Manufacturer, Eurisotop. Product Name, I.E(%), Water content, Packaging, Item Number, Price . Today's D2O share price, stock chart and announcements. View dividend history, insider trades and ASX analyst consensus. d2O/xcUSDT price today is $ with a hour trading volume of $ Deuterium contract address is 0xcbcbafa0ba9f7e3be9bf with. Pricing. · Deuterium oxide, atom % D. View. View Pricing. · Deuterium oxide, deuteration degree min. % for NMR spectroscopy MagniSolv. Calculating The Fair Value Of Duxton Water Limited (ASX:D2O). Simply Wall St Price/Sales (ttm). Price/Book (mrq). Enterprise Value/Revenue. Deuterium (D2O) is worth ¥ as of May 30, (15 days ago). There has not been any price movement for D2O since then. Should there be any price. View today's D2O share price, options, bonds, hybrids and warrants. View announcements, advanced pricing charts, trading status, fundamentals. Deuterium Price Overview. The current Deuterium price is €. The price has changed by % in the past 24 hours on trading volume of €. 28 August - The Deuterium price today is USD. View D2O-USD rate in real-time, live Deuterium chart, market cap and latest Deuterium News. D2O. Melting point, 3,81°C. Boiling point, ,42°C. MW, 20, Manufacturer, Eurisotop. Product Name, I.E(%), Water content, Packaging, Item Number, Price .

Duxton Water stock price, live market quote, shares value, historical data, intraday chart, earnings per share and news. D2O Share Price Performance ; This Year (), $, $, $, $ ; Last Year (), $, $, $, $ Get Duxton Water Limited (litrosfera.ru) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Deuterium oxide deuteration degree min. % for NMR spectroscopy MagniSolv™. CAS , pH 7 (H₂O, 20 °C). · Recommended Products · Pricing & Availability. Heavy water for sale. We're a reliable and trusted Canadian supplier of bulk D₂O. Service-oriented team & worldwide shipping. Inquiries welcome. Going to the bathroom will be an astonishing olfactory experience with fresh and inspiring scents. Buy D2O toilet odor shield now! All the latest Duxton Water Limited (ASX:D2O) share price movements, news, expert commentary and investing advice from The Motley Fool Australia. Isowater® is a leading global supplier of deuterium oxide (D2O) to the life sciences, high technology and environmental science sectors. Isowater, a member of. See what it costs to invest in Duxton Water Ltd (D2O: xasx) and uncover hidden expenses, to decide if SPE is the best investment for you. Nischal Store - Offering Deuterium Oxide Liquid at Rs /kg in New Delhi, Delhi. Read about company. Get contact details and address | ID: Secure your deuterium oxide supply - 70% to % purity available. Reliable supply, expertise & service. Worldwide shipping. Inquiries welcome. Deuterium Oxide atom%D ; 10ML. ₹12, Contact Us ; ML. ₹52, 9. d2O/USDC price today is $ with a hour trading volume of $ Deuterium contract address is 0xcbcbafa0ba9f7e3be9bf with. Convert Deuterium to Ether (D2O to ETH). The price of converting 1 Deuterium (D2O) to ETH is ETH today. Check if litrosfera.ru Stock has a Buy or Sell Evaluation. litrosfera.ru Stock Price (ASX), Forecast, Predictions, Stock Analysis and Duxton Water Limited News. - The live price of D2O is $ with a market cap of $0 USD. Discover current price, trading volume, historical data, D2O news, and more. Discover all the factors affecting Duxton Water's share price. D2O is currently rated as a Super Stock | Stockopedia. Get Deuterium(D2O) price, charts, market capitalization and other cryptocurrency info about Deuterium. Open this page to get detailed information about. Key Insights Duxton Water's estimated fair value is AU$ based on Dividend Discount Model Current share price of Simply Wall St.•10 months ago. Research Duxton Water's (ASX:D2O) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and more.

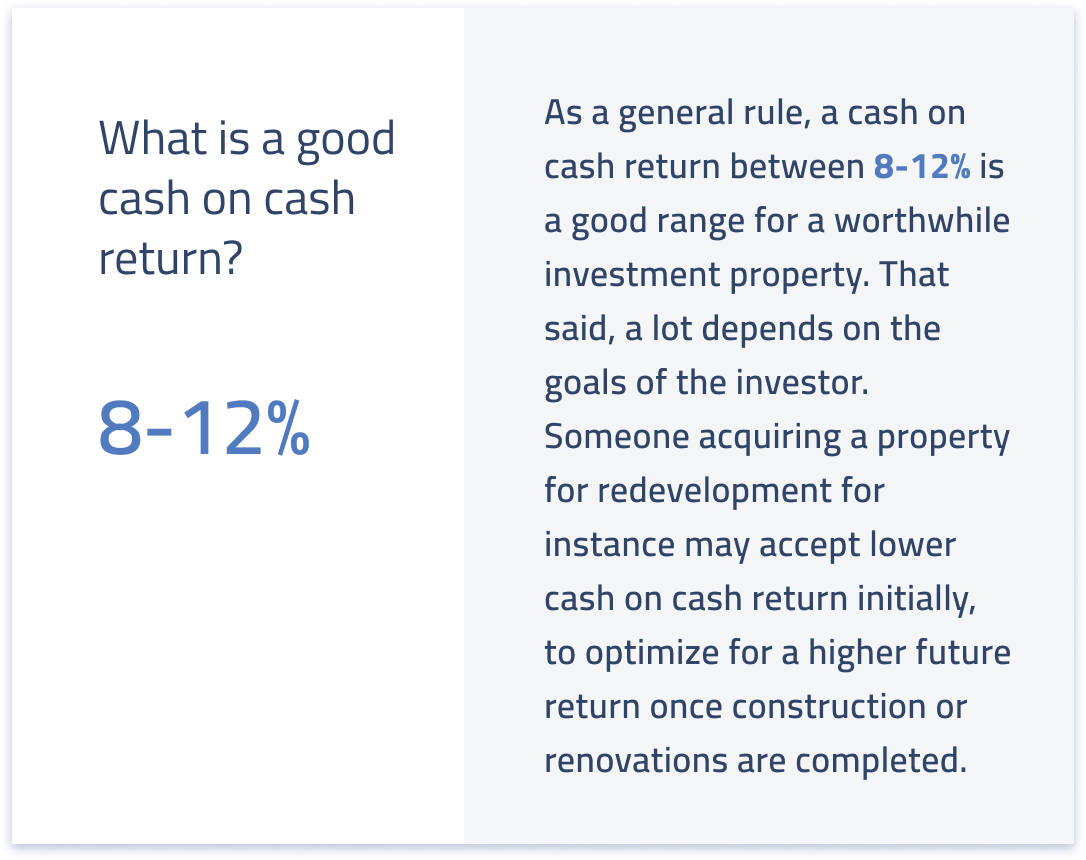

What Is Cash On Cash Return Real Estate

A common metric for measuring commercial real estate investment performance is the cash-on-cash return, which is sometimes also referred to as the cash yield. Cash-on-cash (sometimes called the equity dividend rate) is one of the most common return formats used in the real estate industry. The cash on cash return compares a real estate investment property's annual pre-tax cash flow to the initial equity contribution. The Cash-on-Cash Return of an investment is important when looking at stabilized cash flow on an annual basis. The Cash-on-Cash Return is typically used. Cash-on-Cash Return (CoC): CoC measures the annual return on the actual cash invested in a property. For instance, if you invest $, in a property that. Real estate investors are seeing a generational opportunity to benefit from low interest rates and lock in outsized cash on cash returns by utilizing. Cash-on-cash return is a common metric real estate investors use to measure how much cash flow they can expect from the equity they invest. Cash on cash return is a financial metric used in real estate investing to evaluate the profitability of an investment property. Cash-on-cash return for real estate investors measures the amount of net cash flow a property is generating as a percentage of the total amount of cash. A common metric for measuring commercial real estate investment performance is the cash-on-cash return, which is sometimes also referred to as the cash yield. Cash-on-cash (sometimes called the equity dividend rate) is one of the most common return formats used in the real estate industry. The cash on cash return compares a real estate investment property's annual pre-tax cash flow to the initial equity contribution. The Cash-on-Cash Return of an investment is important when looking at stabilized cash flow on an annual basis. The Cash-on-Cash Return is typically used. Cash-on-Cash Return (CoC): CoC measures the annual return on the actual cash invested in a property. For instance, if you invest $, in a property that. Real estate investors are seeing a generational opportunity to benefit from low interest rates and lock in outsized cash on cash returns by utilizing. Cash-on-cash return is a common metric real estate investors use to measure how much cash flow they can expect from the equity they invest. Cash on cash return is a financial metric used in real estate investing to evaluate the profitability of an investment property. Cash-on-cash return for real estate investors measures the amount of net cash flow a property is generating as a percentage of the total amount of cash.

Cash on cash return is the percentage of annual income your cash investment earns on a real estate investment after debt service. Looking to understand the term "Cash-on-cash Return"? Our comprehensive glossary simplifies "Cash-on-cash Return" as it relates to real estate investing. It is relatively simple to calculate an investor's annual cash-on-cash return on a property. To calculate, take the annual pre-tax net cash flow and divide it. Cash-on-cash return is one of the most widely used metrics in commercial real estate, calculated by dividing annual before-tax cash flow by the total cash. Cash on cash return is a rate of return ratio that calculates the total cash earned on the total cash invested. A cash-on-cash return basically gives you a way of taking the business plan of a property and projecting out the cash distributions while you're holding that. Cash-on-cash return, oftentimes referred to as cash yield, focuses on the annual cash flow generated by an investment relative to the initial cash investment. It is a yield metric that measures your return over a defined period. This cash-on-cash return is in constant flux when revenues and expenditures are correctly. As the name implies, cash-on-cash return[1] calculates the amount of pre-tax cash income an investor could receive from a property based on the amount of cash. The cash-on-cash return is a real estate investment metric that measures the received pre-tax cash flow relative to the amount of money that was invested to. Cash-on-cash return is a metric used to determine the rate of return on the cash invested in a commercial real estate or investment property. A zero cash on cash return property will grow through appreciation, but you can actually use that appreciation for anything. COC is the energy. Cash on cash return is a measure of your net annual cash flow as a percentage of the amount of cash you have invested in a rental property or flip. Cash on cash return is a calculation that determines when you will have made back your cash investments on a multifamily property. Cash-on-cash return takes the entire investment into account, including the amount invested into purchasing a property before any income can be collected. This. The cash-on-cash return is a metric that describes a real estate investor's total return on investment. The calculation is based on the initial amount of money. When comparing the cash-on-cash return to the average annual return on a real estate investment investment opportunities when investing in a real estate. It is relatively simple to calculate an investor's annual cash-on-cash return on a property. To calculate, take the annual pre-tax net cash flow and divide it. Definition: Cash on Cash Return is a rate of return on a real estate investment property based on the cash income earned by the property and the amount of cash. In this case, your cash-on-cash return is %, which means you're generating $ in cash for every $1 you've invested in the property.

Best Stock Guide

The best trading platforms for beginners have low fees, easy-to-use interfaces and attainable minimums. See our best brokerage accounts for beginners here. In particular U.S. equity performance surprised investors, but with higher rates and inflation, coupled with rising geopolitical tensions, still top-of-mind. The Stock Comparison Guide (SCG) helps you compare stocks to choose the best company in an industry or the best company on your watch list. The Stock Comparison. Since it takes work to pick the stocks or bonds of the companies that have the best chance to do well in the future, many investors choose to invest in mutual. It's often a good idea to have an exit plan before you buy a stock. For example, you might decide to reevaluate your position when the stock is up 20% or down. How To Invest in Stocks: A Step-by-Step Guide There is no best option when it comes to where to invest in stocks, only the best option for you and your. To help you navigate markets and make the best investment decisions, Jeremy Siegel has updated his bestselling guide to stock market investing. It's often a good idea to have an exit plan before you buy a stock. For example, you might decide to reevaluate your position when the stock is up 20% or down. 4. Choose your stocks · Diversify your portfolio. · Invest only in businesses you understand. · Avoid high-volatility stocks until you get the hang of investing. The best trading platforms for beginners have low fees, easy-to-use interfaces and attainable minimums. See our best brokerage accounts for beginners here. In particular U.S. equity performance surprised investors, but with higher rates and inflation, coupled with rising geopolitical tensions, still top-of-mind. The Stock Comparison Guide (SCG) helps you compare stocks to choose the best company in an industry or the best company on your watch list. The Stock Comparison. Since it takes work to pick the stocks or bonds of the companies that have the best chance to do well in the future, many investors choose to invest in mutual. It's often a good idea to have an exit plan before you buy a stock. For example, you might decide to reevaluate your position when the stock is up 20% or down. How To Invest in Stocks: A Step-by-Step Guide There is no best option when it comes to where to invest in stocks, only the best option for you and your. To help you navigate markets and make the best investment decisions, Jeremy Siegel has updated his bestselling guide to stock market investing. It's often a good idea to have an exit plan before you buy a stock. For example, you might decide to reevaluate your position when the stock is up 20% or down. 4. Choose your stocks · Diversify your portfolio. · Invest only in businesses you understand. · Avoid high-volatility stocks until you get the hang of investing.

This beginner's guide to investing in stocks breaks down everything you need to know in great detail. Don't have time to read 4, words about the stock market. The iShares Core S&P ETF (IVV) is a good option for beginners here. With an expense ratio of just %, it's essentially free to own. And because the S&P. Learn about stocks and the share market, understand key stock market terms, and start investing wisely. Make informed decisions with this stock market guide. The Neatest Little Guide to Stock Market Investing by Jason Kelly offers a comprehensive introduction to the world of stock investing. It covers key strategies. This book will teach you everything that you need to know to start making money in the stock market today. There are two main kinds of stocks, common stock and preferred stock. Stocks offer investors the greatest potential for growth (capital appreciation) over the. The best way to invest in the stock market is to buy a low cost, total market index fund and basically hold onto it forever (or until you need it). A full-service brokerage account may not be the best option for investors just getting started investing in stocks. These firms often require substantial. The following is a guide to understanding stocks and how to invest If you place a market order, you're committing to buying or selling a stock at the best. "STOCK MARKET FOR BEGINNERS - THE ULTIMATE GUIDE TO $1,," by Financial Education. This is a great on the stock market and how to. There is no single approach to picking the best stocks to invest in. It depends on a few factors, such as the outcome you're trying to achieve. 15 Must-Read Stock Market Books: A Comprehensive Guide for Investors · 1. “The Intelligent Investor” by Benjamin Graham: · 2. “A Random Walk Down. Eager to learn how to invest in stocks? Here's our ultimate guide to master the stock market: Key strategies, what is asset allocation & more. Become In The Top 1% of Stock Market Investors & Learn How To Generate MASSIVE Stock Market Returns. Stocks & shares ISAs Best stocks & shares ISAs A guide to stocks & shares The stock market is your best bet if you want to try to beat inflation · Senior. This newest edition of MarketSmith Stock Guide takes a deep dive into the power of our stock screener. We'll walk you through some top tips for building a. Stocks & shares ISAs Best stocks & shares ISAs A guide to stocks & shares The stock market is your best bet if you want to try to beat inflation · Senior. Stock trading and investing can be daunting for beginners, but this guide investment aims are modest, buying lower risk stocks could be a good option. Investing in the stock market is one of the best ways to grow your savings over the long term. If you're just starting out, it can feel like there's a lot.

Why Invest In Wine

I'm seriously thinking of diversifying and using my industry knowledge to buy and sell top wines and I'm looking to talk with others in the same space. There's a growing trend around investment in fine wine, offering diversification and the potential for returns. Investing in fine wine is a great way to minimize risk to avoid losing money. That's because the demand for top wines has been stable and is. Although different in taste and alcohol content, wine and whisky share some similarities during their production and maturation processes. The Grand Cru wines of Bordeaux and Burgundy have long dominated the scene, but wines from other regions are now gaining traction. Below is an overview. The practice of investing in wine may offer opportunities for a better risk-adjusted return than investors might be able to find through other portfolio. Wine has historically beaten stocks as a long-term investment. Wine has yielded a return of % since Wine investment · 1. Invest in pedigree – wines with a solid track record on the secondary market, the Australian blue-chip wines, top Bordeaux and Burgundy. Leading Fine Wine investment platform in the United States. We make investing in Fine Wine as effortless as drinking it - combining human expertise. I'm seriously thinking of diversifying and using my industry knowledge to buy and sell top wines and I'm looking to talk with others in the same space. There's a growing trend around investment in fine wine, offering diversification and the potential for returns. Investing in fine wine is a great way to minimize risk to avoid losing money. That's because the demand for top wines has been stable and is. Although different in taste and alcohol content, wine and whisky share some similarities during their production and maturation processes. The Grand Cru wines of Bordeaux and Burgundy have long dominated the scene, but wines from other regions are now gaining traction. Below is an overview. The practice of investing in wine may offer opportunities for a better risk-adjusted return than investors might be able to find through other portfolio. Wine has historically beaten stocks as a long-term investment. Wine has yielded a return of % since Wine investment · 1. Invest in pedigree – wines with a solid track record on the secondary market, the Australian blue-chip wines, top Bordeaux and Burgundy. Leading Fine Wine investment platform in the United States. We make investing in Fine Wine as effortless as drinking it - combining human expertise.

Trade or sell your wine. Start investing in your unique wine portfolio, where you can sell, value, store, collect and manage your fine wine portfolio as you. Wine has intrinsic value that makes it suitable for preserving wealth as a medium to long-term investment. The practice of investing in wine may offer opportunities for a better risk-adjusted return than investors might be able to find through other portfolio. Wine is a low-risk investment. Physical assets like fine wine are stable sources of value in times of uncertainty. While stock markets can crash and share. A vineyard investment may be an exciting prospect for wine enthusiasts and a great portfolio diversification strategy. But, it is capital intensive. The market for wine is really taking off right now. But it is still in its infancy, with plenty more room to grow from exploding demand. Wine investment refers to the acquiring of specific wines with the intent to sell them at a future date once the wine's value has improved. We'll uncover the multifaceted layers of wine investment, a realm where the deep appreciation for fine vintages and the intricate art of winemaking converges. Here are ten gold rules to help you avoid giving your valuable savings to a fraudster. 1) Cold calls and high pressure sales Never buy from a wine investment. Invest In Wine: Top 6 Reasons | Vint · 1. There's a High ROI · 2. Supply & Demand · 3. Even If the Market Crashes, Wine Retains Value · 4. Investors are Always. 3. Determine How Much You Can Invest A common recommendation is that you need a minimum of $10, to start investing in fine wine. Just like with dividend-. The “right” way to invest in wine · Get a commercially viable cellar · Buy the wine you want to drink · If a lot you have appreciates well above. Wine can be a great alternative asset for your portfolio. Learn more about how to collect and invest in fine wine with City National Bank. You can invest in wine futures or indexes, or even through a wine investment company that does all the picking and choosing for you. The wine estate combines pleasure, nature and space, values which are becoming more and more essential and which will be, tomorrow, one of the guarantors of. Wine investment is in general less volatile than equities. It is also a consumable asset so no capital gain tax imposed. Wine Investing Prerequisites · Prepare to Wait Years: Wine is not typically a fast turnaround investment. · Minimum 3+ Bottles of Investment Wine. Wine is an excellent way to invest in assets that are not subject to the fluctuations of the financial markets. It's an alternative investment with moderate. Investment wine Investment wine, like gold bullion, rare coins, fine art, and tulip bulbs, is seen by some as an alternative investment other than the more.

Virtual Number To Verify Google Voice

Outlined below are the necessary steps to acquire a virtual phone number for Gmail verification. Step 1: Go to litrosfera.ru and click on “Create an. Yes, many financial apps accept Google Voice numbers for verification. For instance, apps like PayPal and Cash App also allow the use of Google. You cannot verify Google Voice with a virtual or VOIP phone number. Step 3. Verify Google Voice Number with actual number. Choose a phone that you can access, type its number, and click Send code. Try using a landline, then add your cell number. Then remove the landline. For as long as I have used GV, I have always done it this way. Seems. Fraudsters will sign their targets up for Google Voice to access their verification code and hijack the account and personal information. Verify your google account for FREE with our virtual phone numbers. SMS / Phone verification made simple. Discover the benefits of using a temporary phone number when making purchases through E-Garant at Walmart. Avoid spam calls and protect your privacy while. Find out if there is a way to avoid phone number verification when signing up for Google Voice and which one is the most efficient. Outlined below are the necessary steps to acquire a virtual phone number for Gmail verification. Step 1: Go to litrosfera.ru and click on “Create an. Yes, many financial apps accept Google Voice numbers for verification. For instance, apps like PayPal and Cash App also allow the use of Google. You cannot verify Google Voice with a virtual or VOIP phone number. Step 3. Verify Google Voice Number with actual number. Choose a phone that you can access, type its number, and click Send code. Try using a landline, then add your cell number. Then remove the landline. For as long as I have used GV, I have always done it this way. Seems. Fraudsters will sign their targets up for Google Voice to access their verification code and hijack the account and personal information. Verify your google account for FREE with our virtual phone numbers. SMS / Phone verification made simple. Discover the benefits of using a temporary phone number when making purchases through E-Garant at Walmart. Avoid spam calls and protect your privacy while. Find out if there is a way to avoid phone number verification when signing up for Google Voice and which one is the most efficient.

In general there is no upper limit. You can use each virtual number for different accounts and as many verifications as you want. Depending on your Blacktel. Our virtual number SMS services allow you to overcome the verification challenges without getting a real number in real life. This helps you to save costs and. You can also use a virtual phone number to receive SMS verification codes and verify your account. You must buy a number from a reliable service provider to use. They can call you, leave voice messages, or drop you an SMS or MMS from their local number. number to verify a service such as WhatsApp, Google, or Facebook. Verify your googlevoice account for FREE with our virtual phone numbers. SMS / Phone verification made simple. Using a VPN(ExpressVPN, NordVPN, Surfshark) · Use a temporary US number(GetFreeSMSonline, TextVerified) · Obtaining a US Virtual number from a trustworthy service. 2 problems: do not use Google voice numbers, Google has blacklisted VSim numbers, you will not be able to get a Google number using VSim. Google Voice should. Are you searching for PVA SMS Text verifications for Google Voice? All our numbers are real sim cards to verify any Google Voice account sign up and creation. Step 1: Sign in to Google Account · Step 2: Access Google Voice · Step 3: Select Your Number · Step 4: Link Your Existing Phone Number · Step 5. Free Google Voice SMS verification service without registration. Get your free non-VoIP phone number now! It issues users a virtual number that must be tied to a real phone, of which, will receive the calls or texts the virtual number receives as Google Voice sends. Welcome to VirtuNum, the solution for enhancing online security through 2-step verification code across all apps and websites globally. Verify any online account without revealing your phone number. Use our temporary US non-VoIP numbers to receive SMS and voice calls online. Virtual Numbers App provides clean, private, non-recycled phone numbers guaranteed to work with TEMU, WhatsApp, Telegram, Signal, Viber, WeChat, and others! Creating a Google Account with a Virtual Number · Start at Google's Sign-Up Page: Navigate to Google's account creation page. · Enter Basic Information: Provide. Welcome to VirtuNum, the solution for enhancing online security through 2-step verification code across all apps and websites globally. With Google Voice Extensions (GVE), you'll create a phone number dedicated to Google Voice calls, called your Google Voice Virtual Number (GVVN). Whenever. Go to Google Voice for Business. · Choose a Google Voice number. · Click on the 'Verify' button to verify the number. · Enter a non-VoIP phone number to link to. One limitation of using Google Voice for SMS verification is that some platforms do not accept virtual phone numbers for verification purposes. This is because. Google Voice offers free virtual numbers that can be used for Gmail verification. You can choose a number from a list of available options and link it to your.

Cheapest Way To Buy Stocks

While stocks prices rise and fall, profitable stocks can help your money grow. It is a way to measure how much income you are getting for each dollar. These individuals are known as day traders. They rose to prominence in the s as the development of inexpensive desktop computers and software programs made. The cheapest way to day trade the stock market is through RobinHood, at least if you're defining 'cheap' as not having upfront. But teens who want to invest in the stock market are not going to find investing only $1 appealing. So, let's explore other ways to get money for investing in. This tends to drive the prices of those well-performing stocks even higher near the month-end. way to take advantage of them. As a result, any returns. Stock funds are another way to buy stocks. These are a type of mutual fund that invests primarily in stocks. Depending on its investment objective and policies. The best cheap stocks to buy ; Amcor (AMCR), $, ; Arcadium Lithium (ALTM), $, ; Kosmos Energy (KOS), $, ; Valley National Bancorp (VLY). Stock Exchange, but these days very few stock trades happen this way. Today, the easiest option is to buy shares online through an investing account. A. The easiest way, in terms of getting a trade done, is to open and fund an online account and place a market order. While this is the quickest way to buy stocks. While stocks prices rise and fall, profitable stocks can help your money grow. It is a way to measure how much income you are getting for each dollar. These individuals are known as day traders. They rose to prominence in the s as the development of inexpensive desktop computers and software programs made. The cheapest way to day trade the stock market is through RobinHood, at least if you're defining 'cheap' as not having upfront. But teens who want to invest in the stock market are not going to find investing only $1 appealing. So, let's explore other ways to get money for investing in. This tends to drive the prices of those well-performing stocks even higher near the month-end. way to take advantage of them. As a result, any returns. Stock funds are another way to buy stocks. These are a type of mutual fund that invests primarily in stocks. Depending on its investment objective and policies. The best cheap stocks to buy ; Amcor (AMCR), $, ; Arcadium Lithium (ALTM), $, ; Kosmos Energy (KOS), $, ; Valley National Bancorp (VLY). Stock Exchange, but these days very few stock trades happen this way. Today, the easiest option is to buy shares online through an investing account. A. The easiest way, in terms of getting a trade done, is to open and fund an online account and place a market order. While this is the quickest way to buy stocks.

Define Your Goals and Strategies · Want to buy and sell stocks online? · Research the companies you want to invest in · Obtain a Quote · Place the Trade · Things to. One of the easiest ways to buy and sell stocks or manage any investment portfolio is to open an online taxable brokerage account. This is often appealing to. buy stocks at their highest prices. Your objective isn't to buy at the 98 % of individual investors buy stocks this way and it is not effective. The cheapest and simplest way to buy stocks is to use an online broker and place the trades yourself. These charge anywhere from $0–$30 per trade in brokerage. The best way to invest in the stock market is to buy a low cost, total market index fund and basically hold onto it forever (or until you need it). While 'penny stocks', for example, might look cheap at 10 to 20 cents per Be wary, too, of buying shares just because prices are falling. A company. The cheapest way to buy shares is online but we'll be happy to talk you Open your ISA from £, or £25 per month. Open a Stocks and Shares ISA · More on the. Your Guide to Self-Directed Stock Trading Online · Method 1: Buying Directly From The Company · Method 2: Opening A Dividend Reinvestment Account · Method 3: Using. Cheap stocks are shares of companies that are priced lower than the average price of stocks in the market. In other words, they are stocks that trade at a lower. Another important aspect to consider is buying the shares at an high price or at a low price. Low price will be better because that way you'll earn more money. How to buy shares The easiest and cheapest way to buy shares is online from a 'share dealing platform' (see platforms to try). These platforms allow you to. You need a Vanguard Brokerage Account to trade stocks and ETFs (exchange-traded funds). It's easy to get started, and we can help you along the way. The most common way to buy and sell shares is by using an online broking service or a full service broker. A good way to start thinking about potential stocks is to consider the companies and brands you use every day. There are a number of resources and tools. The cheapest and simplest way to buy stocks is to use an online broker and place the trades yourself. These charge anywhere from $0–$30 per trade in brokerage. The best cheap stocks to buy ; Amcor (AMCR), $, ; Arcadium Lithium (ALTM), $, ; Kosmos Energy (KOS), $, ; Valley National Bancorp (VLY). If it's the other way around, demand is less than supply, prices go down. But why do stock prices fluctuate? The market does a pretty good job of working out. Unlike trading equity or ETF options, which are equivalent to shares of a stock per contract, you're able to place stock and ETF orders that are less than. The easiest way to get started with buying stocks is to use an online broker. These investment platforms are offered by big Canadian banks as well as. But when news breaks outside of trading hours, an imbalance between buy and sell orders may cause a stock to open dramatically higher or lower than its price at.

Free Cash Flow Companies

Highest Free Cash Flow Yields (FCF percent of share price). ; Oasis Midstream Partners. OMP. $ ; PBF Logistics. PBFX. $ ; Global Partners. GLP. $ It's the cash flow left over after investment, and can be used by the company to purchase other firms, pay dividends, reduce debt, or buy back stock. Young. Free cash flow (FCF) represents the cash a company can generate after accounting for capital expenditures needed to maintain or maximize its asset base. Why SFLO? Exposure to high quality small cap companies, trading at a discount with favorable growth prospects; Considers a company's expected FCF. As a quality investor you believe that the best companies – those of highest “quality” – are the ones most likely to outperform the market over time. We agree. Free cash flow is related to, but not the same as, net income. Net income is commonly used to measure a company's profitability, while free cash flow provides. In this article we unpack the best Free Cash Flow Yield stock ideas from across the globe, including North America, Europe, and Asia. Free cash flow (FCF) yield is a financial solvency ratio that measures your free cash flow in relation to your market capitalization. Free cash flow is one of the most important ways to measure a company's financial performance. It demonstrates the cash flow a company can potentially. Highest Free Cash Flow Yields (FCF percent of share price). ; Oasis Midstream Partners. OMP. $ ; PBF Logistics. PBFX. $ ; Global Partners. GLP. $ It's the cash flow left over after investment, and can be used by the company to purchase other firms, pay dividends, reduce debt, or buy back stock. Young. Free cash flow (FCF) represents the cash a company can generate after accounting for capital expenditures needed to maintain or maximize its asset base. Why SFLO? Exposure to high quality small cap companies, trading at a discount with favorable growth prospects; Considers a company's expected FCF. As a quality investor you believe that the best companies – those of highest “quality” – are the ones most likely to outperform the market over time. We agree. Free cash flow is related to, but not the same as, net income. Net income is commonly used to measure a company's profitability, while free cash flow provides. In this article we unpack the best Free Cash Flow Yield stock ideas from across the globe, including North America, Europe, and Asia. Free cash flow (FCF) yield is a financial solvency ratio that measures your free cash flow in relation to your market capitalization. Free cash flow is one of the most important ways to measure a company's financial performance. It demonstrates the cash flow a company can potentially.

FCF Advisors is a global leader in Free Cash Flow-based investment strategies. Our methods of identifying quality companies are more reliable. Why? Because the. Financial statements providing information of a company's cash flows yield a better measure of operating performance than do the company's income statement and. Apple Inc.: Apple is widely regarded as one of the most successful companies in terms of generating free cash flow per share. The tech giant consistently. In simple words, FCF is the money left after paying for things such as payroll, taxes and a company can use it as per its wish. A company's ability to generate. Companies with free cash flow ; 1. Athena Global, , , ; 2. Franklin Indust. , , Free Cash Flow = Operating Cash Flow - Capital Expenditures; Operating Cash Flow is the cash a company generates from its core business operations. Investments. In financial accounting, free cash flow (FCF) or free cash flow to firm (FCFF) is the amount by which a business's operating cash flow exceeds its working. Free cash flow is the amount of cash a company has generated after considering cash outflows for the period. The cash flow calculation in Stock Investor calculates free cash flow by subtracting capital expenditures and dividends from operating cash flow on the cash. Companies with free cash flow · 1. Athena Global, , , , , , , , , , , , · 2. Franklin. To have a healthy free cash flow, you want to have enough free cash on hand to be able to pay all of your company's bills and costs for a month, and the more. The VictoryShares Free Cash Flow ETF seeks to offer exposure to high-quality, large-cap US stocks that trade at a discount and have favorable growth prospects. Free cash flow is the cash a company generates after accounting for operating and capital expenditures. Free cash flow yield is defined as a company's free cash. Free cash flow (FCF) measures your startup's remaining cash after accounting for necessary day-to-day operating expenses. It's a significant indicator of the. Positive free cash flow indicates a company is generating more cash than it needs to run the business and can invest in growth opportunities. Companies. Investment cash flow refers to the cash used for long-term investments. This can include the purchase or sale of property, plant, and equipment, as well as. Free cash flow is typically calculated as cash flows from operating activities, a standard accounting metric, less capital expenditures. Equity analysts like to. If a company cannot afford its operating expenses, it will eventually go out Overall, understanding a company's cash situation is crucial to making. Free cash flow is a measure that can help show how much money a business actually generated in a specific period. It starts with net income, which is then.